Zinc

Long-term

Prospects

Remain

Intact

NEAR-TERM PRICING HEADWINDS

Zinc LME prices remained volatile during FY 2019-20, starting off the year at $3,000 per tonne plus levels and gradually cooling off on the back of continued trade tensions between the US and China. This downward spiral started waning off from September in anticipation of a trade agreement between the two countries. Later, the phase one trade deal provided some support to prices, only to fall subsequently with the outbreak of the COVID-19 pandemic, which pushed prices below $2,000 per tonne by March 2020.

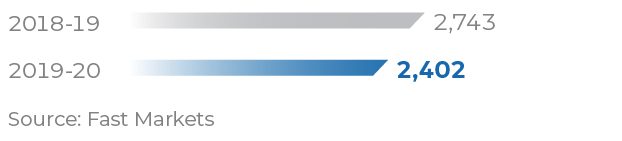

Overall, the price of the metal recorded an average decline of 12% when compared to FY 2018-19 in spite of average inventory with the exchanges remaining less than a week of global consumption.

Average Zinc LME Cash Settlement Prices

($/t )

ZINC DEMAND-SUPPLY DYNAMICS

In FY 2019-20, the zinc market continued to remain in deficit though the gap between refined supply and demand narrowed. Refined metal supply increased by 5.1%, mainly due to increase in Chinese refined metal output as smelters restarted after temporary shutdowns due to environmental regulations. The rest of the world recorded a decline in production due to a combination of factors such as the forced shutdown of major smelters due to technical issues and delays in a couple of big projects.

Zinc consumption, on the other hand, declined by 3.3% during FY 2019-20, primarily due to sluggish economy leading to weakening demand from the automotive and construction sectors and the pandemic outbreak in the last quarter.

In India, zinc demand until Q3 FY 2019-20 was not impacted and almost remained at FY 2018-19 levels amid a steady rise in the usage of galvanised steel by various sectors, especially infrastructure. In Q4, zinc demand contracted with the outbreak of the pandemic and the ensuing nationwide lockdown, which halted manufacturing activities. Overall, this led to a contraction of 2.5% in the primary zinc market demand for FY 2019-20.

OUTLOOK

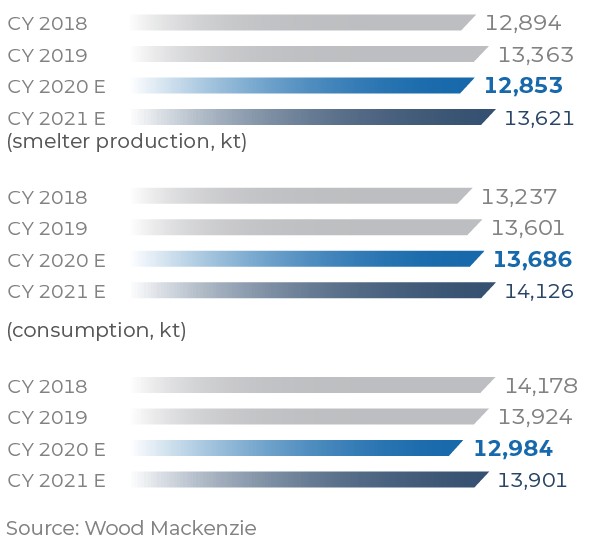

More than 25% of global annualised zinc supply has been impacted by lockdowns and workforce curtailments. In several countries across the globe, plans to restart mines or resume normal production have been pushed back due to restrictions and short-term absenteeism. The decline in LME prices may have also made many mines economically unviable. If these prices persist, some high-cost miners may be forced to shut their operations and new investments may get delayed, pushing the mine supply to a deficit versus demand for concentrates by smelters. This will, in turn, provide support to metal prices and reduce the treatment costs charged by smelters to the mines. According to Wood Mackenzie, mine production is expected to contract by 4% with a further downside risk, given the ongoing situation.

Some of the Chinese smelters have resumed production towards the end of March while smelters in the rest of the world are being impacted by manpower issues.

Trends in Production and Consumption

(mine production, kt)

Refined Metal Stocks

(Zinc LME, SHFE stocks and prices

With the constraints on mine supply, it is expected that smelters will also cut output, as was reflected in the fall of China spot TCs for imported concentrates from $265 to $185 at the end of April.

On the global zinc consumption side, the demand is expected to contract for the third consecutive year due to lockdowns, boundary closures and restricted movement. However, prices are likely to move upwards as the impact of coronavirus pandemic wanes off in the latter half of the year.

Overall, we expect that zinc metal supply will match up to its demand and while the warehouse stocks may trend up in the near term, the zinc price will find support from lower mine and smelter production this year. Both supply and demand are expected to recover in 2021 as the impact of pandemic fades and normalcy returns.

OPPORTUNITIES IN THE INDIAN MARKET

- Under-penetration of galvanised products in car bodies in India - 70% galvanisation benchmark in Body-in-White (BIW) for developed countries offers huge potential versus the Indian average at 20%

- Healthy demand driven by the 100% rural electrification programme

- Finance ministry’s focus on `1 Lakh Crore investment in electricity, road and new airports

- Target to complete electrification of Indian railways in three years - ~13,675 km at a cost of `12,134 Crore will boost the demand for zinc

- New demand to come from Continuous Galvanised Rebar (CGR) as the industry realises its significant benefits, including the overall increase in life of projects and enhanced safety

- The World Bank, along with the International Zinc Association, is working in the state of Rajasthan to increase awareness on the importance of zinc in crops through balanced fertiliser use

A SNAPSHOT OF OUR PERFORMANCE AND OUTLOOK

- We maintained our market share in primary zinc for FY 2019-20 and target to increase it further in FY 2020-21

- We have increased our VAP sales from 16% to 18.5% in FY 2019-20, which is expected to reach 25% of our total sales in FY 2020-21

- We resolved all customer complaints through our online CRM system and have offered just-in-time inventory to our long-term partners

- Hindustan Zinc will be the first producer in the non-ferrous industry in India to launch its own e-commerce platform ‘E-volve’. This platform will help customers with real-time pricing and seamless click-buy facility for zinc, lead and silver. The e-commerce platform will also help reach the small and micro customer segment, thereby gaining additional market share of 2% in FY 2020-21