Lead

Traction in

Energy Storage

FUNDAMENTALS HOLD THE PRICE SUPPORT

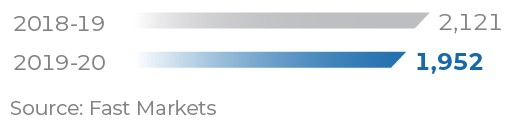

In sync with prices of other base metals, lead prices too headed south amid intensifying trade disputes between the US and China. Weakening global economy, spread of COVID-19 and falling automotive sales were other factors exerting a downward pressure on lead prices. The average lead prices were at $1,952 per tonne during the year, down by 8% over FY 2018-19. LME stocks remained flat during the year.

Average Lead LME Cash Settlement Prices

($/t )

LEAD DEMAND-SUPPLY DYNAMICS

Slowing global economic activity combined with the pandemic outbreak has also affected the lead consumption globally, as demand contracted by 0.8% during FY 2019-20. Overall, the lead market was balanced with higher production from secondary smelters partly offsetting the decline in primary lead production.

LME Prices and LME Stocks

OUTLOOK

Mine production amid the COVID-19 lockdown is expected to contract by 8.2% in CY 2020 and contraction in demand is expected at 5-6%, likely to rebound in CY 2021, bringing the lead market back into balance. Rising adoption of lead-acid batteries due to their lower cost of storage, improved charging time and energy transfer rate will boost demand for lead over the next few years.

Trends in Production and Consumption

(mine production, kt)

(production at secondary refineries, kt)

(consumption, kt)

(production at primary smelters, kt)

(refined lead production, kt)

Source: Wood Mackenzie

OPPORTUNITIES IN THE INDIAN MARKET

- Adoption of the start-stop (idle-stop) technology in conventional vehicles will boost demand for lead due to 25% more metal being used

- Growing adoption of Electric Vehicles (EVs) will boost demand for lead auxiliary batteries

- Regulatory push to the renewable energy sector (wind, solar, etc.) will aid demand for lead-acid batteries, which are primarily used as storage devices because of their high capacity and low-cost design

- Demand for high purity lead alloys to increase the life and performance of lead-acid batteries, which will boost the replacement of secondary lead with our LME registered brands

A SNAPSHOT OF OUR PERFORMANCE AND OUTLOOK

- We grew domestic lead sales by 3% in FY 2019-20

- About 86% of our lead production is sold in the domestic market

- In FY 2020-21, we plan to increase sales through new customers via an e-commerce platform

- We have kickstarted a market research for lead-based alloys and are exploring the manufacturing of lead plates for battery manufacturers

- We received no quality complaints during the year from our customers

- We continued to maintain strong relationships with leading Indian battery OEMs and increased our share of wallet with them