Silver

Investor Interest

Deepens

BENEFICIARY OF THE SAFE HAVEN STATUS AMID UNCERTAINTY

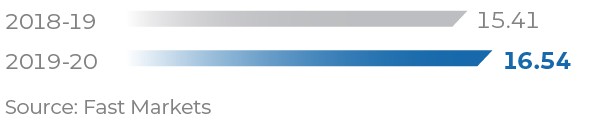

As investors accelerated the shift towards relatively safer precious metals, the average silver price for the year rose 7% from FY 2018-19 to $16.54 per ounce. Rising geopolitical tensions and economic slowdown propelled the US Federal Reserve to announce five interest rate cuts, totalling 2% in the year gone by. While these measures act as a tailwind for silver prices, their benefits will accrue in a gradual manner.

Average Silver Prices

($/ounce )

OUTLOOK

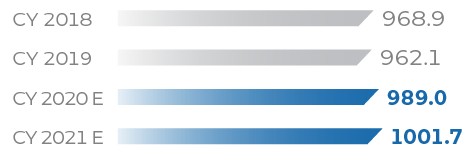

Silver demand and prices move in tandem with investor preference as it enjoys the safe haven status in turbulent times. However, silver also has valuable applications as an industrial metal and has strong demand prospects in industries such as electronic semiconductors, batteries, solar panels, water purification, automotive electronics and LED lighting, all of which augur well for the metal price trend over the medium term.

Going forward, the roll-out of 5G telecom networks is also expected to propel silver demand and will act as one of the important drivers of silver prices. Silver is one of the key components of semi-conductors used for network equipment and other related communication devices.

Silver Demand-Supply Dynamics

(mine production, Moz)

(total demand, Moz)

(market balance, Moz)

OPPORTUNITIES IN THE INDIAN MARKET

- Consistent demand from multiple industries such as brazing alloys, electrical contacts, photography, high-capacity silver-zinc or silver-cadmium batteries, printed circuits and other electronic applications

- Continued demand from investors to achieve higher portfolio diversification

- Photovoltaic demand is an increasing trend driven by the rising popularity and cost-effectiveness of solar power

A SNAPSHOT OF OUR PERFORMANCE AND OUTLOOK

- We are now the sixth largest silver producer in the world

- Introduced silver powder in the Indian market

- E-auctions initiated for better price discovery and higher premium offering equal opportunity and transparency in the process

- International partnerships being studied for efficiency in the silver value chain and application of blockchain technology

- Indian silverware demand fell during the year, but as demand improves, we foresee a gradual resumption