Key Performance Indicators

Enhancing Resilience to

Remain Future-ready

BUSINESS ACTIVITIES

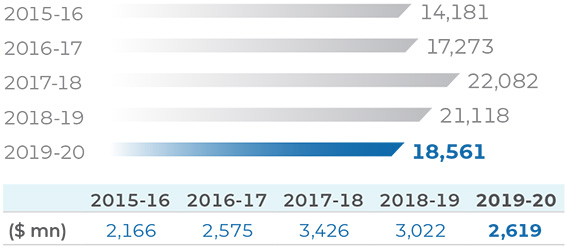

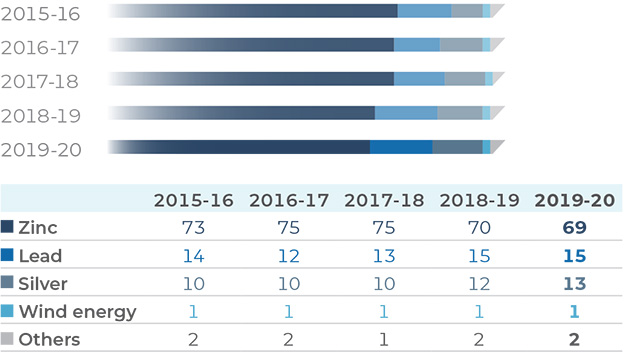

Our revenue and profits were impacted by cyclically weak zinc and lead prices that were down by an average 12% and 8%, respectively, during the year. Silver bucked the trend with price up to 7%, acting as a safe haven for investors.

Our balance sheet continues to be strong with zero debt^ and we generated `6,621 Crore in operating cash flow during the year.

![]()

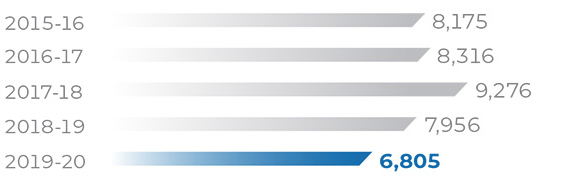

Revenue from Operations$

(` Crore) (including other operating income)

Revenue Mix

(%)

EBITDA

(` Crore)

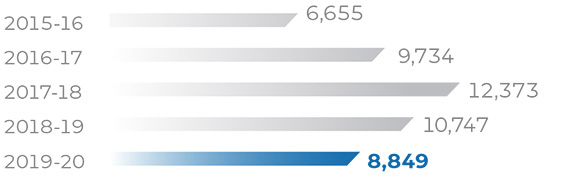

PAT

(` Crore)

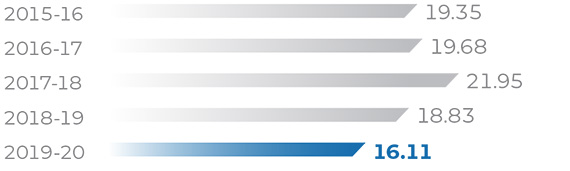

Earnings Per Share (EPS)

(` )

Dividend Per Share (DPS)

(` )

Networth

(` Crore)

Cash and Equivalents**

(` Crore)

![]()

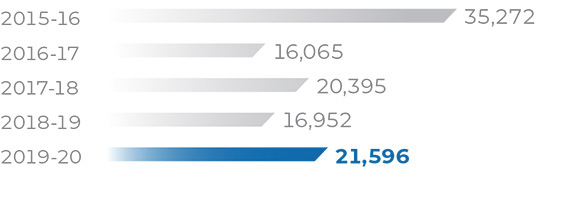

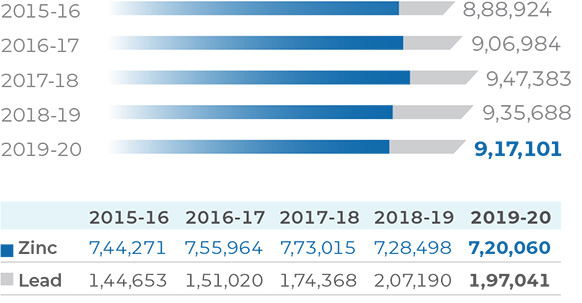

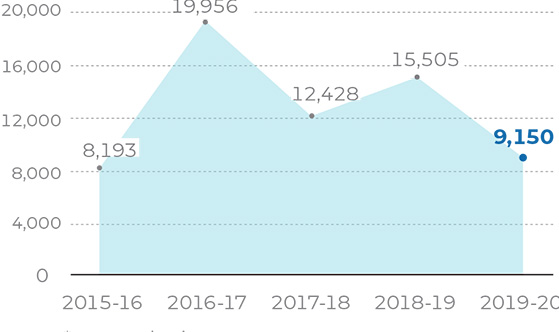

Mined Metal

(MT)

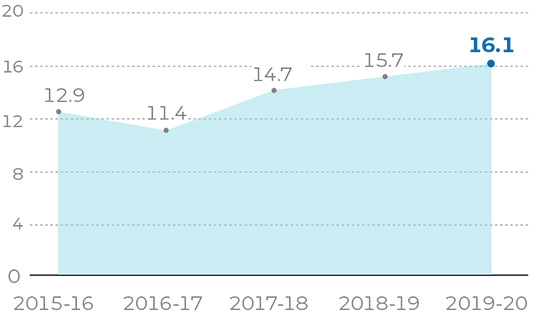

Total Refined Metal***

(MT)

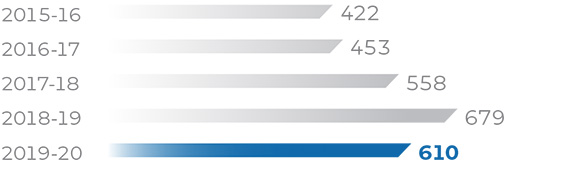

Refined Silver***

(MT)

^`611 Crore working capital and fund-based banking facilities as on March 31, 2020

$net of excise duty till 2017-18

&Interim dividend paid in May 2020

** Includes cash and cash equivalents, net dividend account balance,

short-term borrowings and current investments as applicable

***Excludes captive consumption

ESG PERFORMANCE

Our performance improved on several ESG metrics on the back of sustainability and technology efforts carried out over the last few years. The increased use of recycled and treated water, improving smelter efficiency, higher metal recoveries, gainful utilisation of water and focus on renewable power led to the conservation of natural resources and lower impact on environment. We are focusing on contractor safety, industrial hygiene and rigorous training of our workforce to keep our workplace safe for all. Also, we are investing in many community-focused projects.

![]()

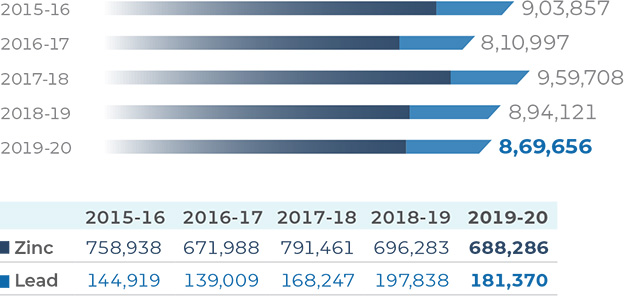

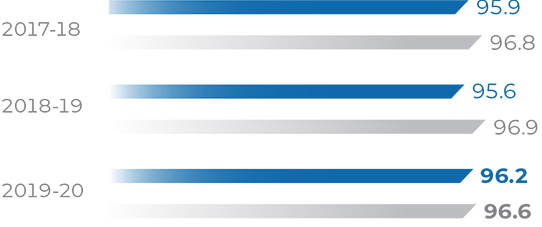

Improvement in Metal Recovery Performance

Mill Recovery

(%)

Smelter Recovery

(%)

![]() Zinc

Zinc ![]() Lead

Lead

![]()

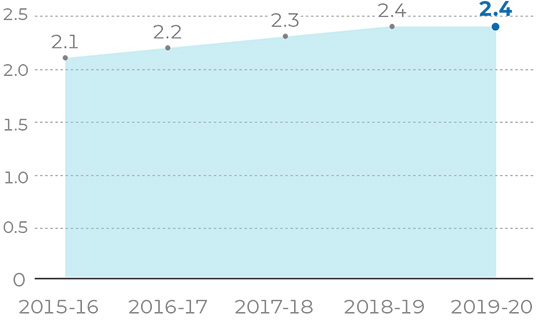

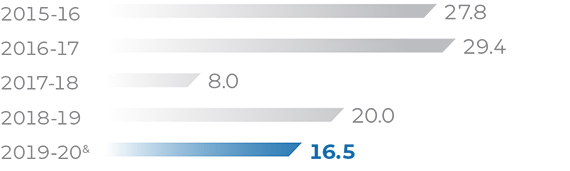

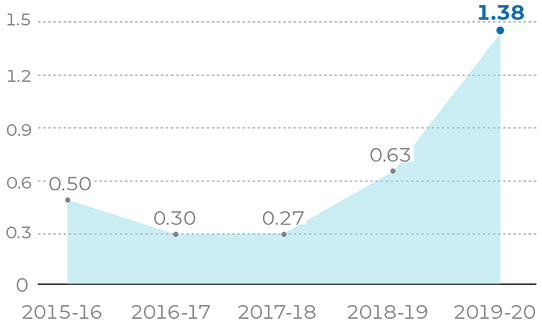

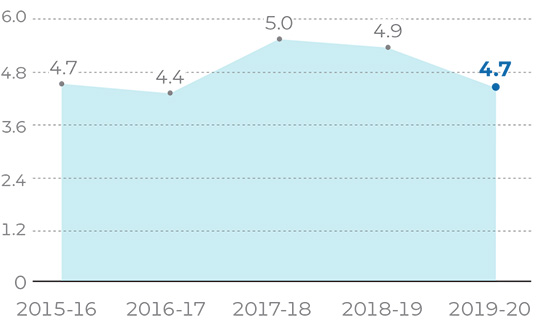

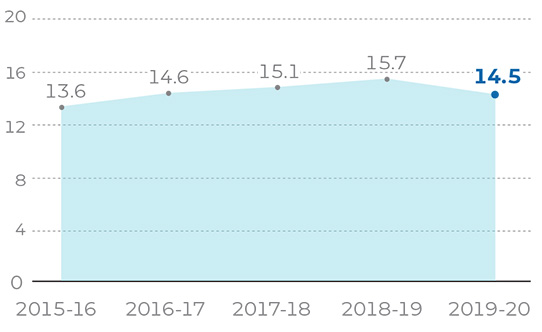

Lost Time Injury Frequency Rate (LTIFR)

(number per mn hours worked)

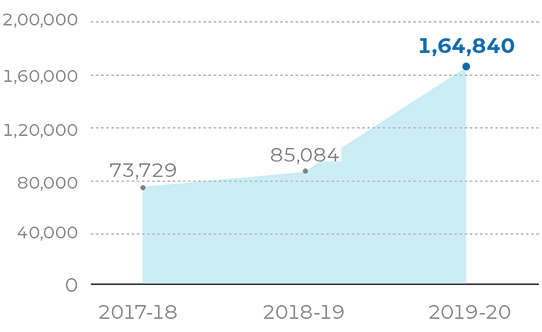

Employee Trainings

(man-hours)

![]()

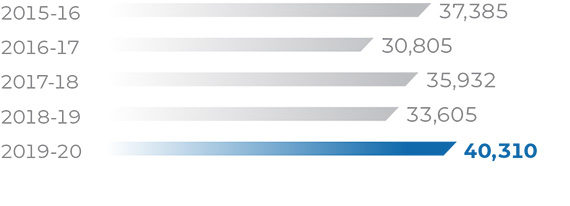

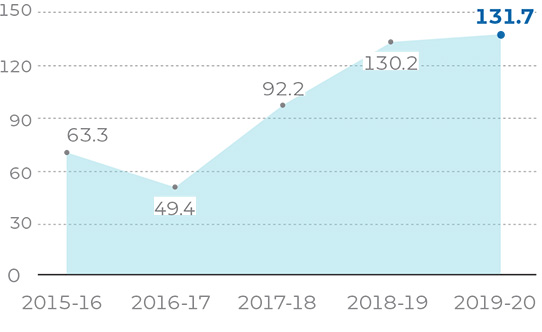

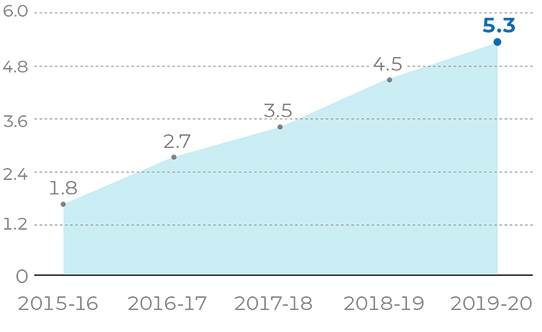

CSR Spend

(` Crore)

Contribution to Exchequer*

(` Crore)

*on gross basis

![]()

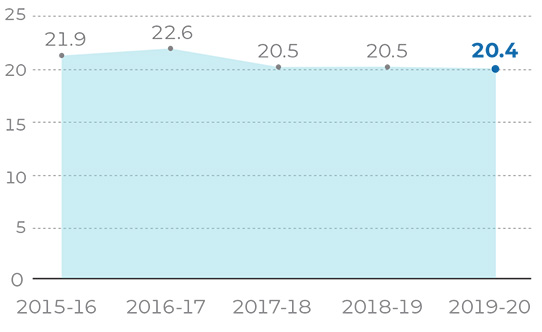

Water Recycled

(Million m3)

Waste Recycled

(Million MT)

![]()

GHG Emission: Scope 1 + Scope 2

(MNtCO2)

Specific Water Consumption

(m3 per MT of metal)

Specific Energy Consumption

(GJ/MT of metal)

Renewable Power (Wind+WHRB+Solar)

(MGJ)